A New Horizon for Solar Appliances

In this blog, we explore the key differences and similarities between electric pressure cookers, cold rooms, e-mobility and milling equipment and how we can use these equipment to drive progress across multiple Sustainable Development Goals (SDGs), to advance food security, gender equality, and equitable social and economic development in off-grid and weak-grid communities

By Bejun Bakrania (Energy Saving Trust), Chris Beland (Energy Saving Trust), Wendy Hado (CLASP) Makena Ireri (CLASP) and Ruth Kimani (CLASP)

This blog is the third in a four-part series featuring key findings from Efficiency for Access’ 2021 Solar Appliance Technology Briefs. This series provides a synthesis of cross-cutting trends for 11 off-grid appropriate appliances, equipment and enabling technologies, grouped by relative market maturity. Category groupings include near-to-market appliances (TVs and fans), emerging appliances (SWPs and refrigerators), horizon appliances (electric pressure cookers, cold storage, milling equipment and e-mobility) and enabling technologies (permanent magnet motors, ICT equipment and interoperability).

In this blog, we explore the key differences and similarities between electric pressure cookers, cold rooms, e-mobility and milling equipment. We categorise these products as “horizon” appliances because they show promise for applications in off- and weak-grid areas, but are generally nascent in comparison to near-to-market appliances (TVs and fans) and emerging appliances (SWPs and refrigerators) (Figure 1). While some regional distinctions exist (e.g., cold storage, e-mobility and solar milling are all further developed in India), there continues to be a lack of both quantitative and qualitative data on which to perform comparisons across all technologies in this category. When considered against the typical product life cycle, horizon appliances fall squarely in stage 1 (market development), with some products on the cusp of stage 2 (market growth). These technologies are characterised by unproven demand, technology that has not been fully proved and low but steady sales. Once demand and sales begin to accelerate, horizon technologies are primed for “take-off” and market growth.

Horizon Appliances: The Future of Energy Access

Over the last decade, we have witnessed increasing electrification rates in emerging economies in Sub-Saharan Africa and Southeast Asia from expanded grid connections and access to distributed energy solutions (i.e., solar home systems and mini-/micro-grids). From 2010–2021, the global population without access to electricity dropped from 1.2 billion to 759 million.

As more people gain access to electricity, a new class of appliances and equipment has emerged that have the potential to reshape the way we deliver energy access. By catalysing nascent markets for these technologies, we can advance multiple SDGs and achieve greater food security, gender equality and more equitable social and economic outcomes in off-and weak-grid communities.

EPCs, for example, can leverage increasing electrification rates to improve and expand access to clean cooking for the 2.6 billion people who primarily rely on biomass and other polluting cooking fuels. Approximately 4 million premature deaths occur each year due to adverse health impacts from cooking with biomass stoves. Women’s socio-economic livelihoods are disproportionally impacted by time drudgery associated with cooking (e.g., fuel collection and tending cookstoves). EPCs have the potential to improve health outcomes and livelihoods and also reduce household energy expenditure depending on the electricity tariffs and cost of local fuels. A forthcoming Efficiency for Access report surveyed Kenyans who purchased an EPC through the Global LEAP results-based financing program; 92% of respondents said their EPC improved their quality of life. Of that 92%, 35% attributed their EPC to a decrease in expenses, 31% attributed it to improved time savings and 29% to increased cooking convenience.

Solar-powered mills offer health benefits and improved livelihoods for women, particularly for rural off- and weak-grid communities. Solar mills allow rural enterprises to save money by lowering operating costs, which can increase incomes. By reducing diesel fuel use, solar mills can help lower greenhouse gas emissions and improve ambient air quality. Emissions from the production of components such as batteries and solar panels are usually small compared to the manufacturing of a diesel engine and the continuous emissions from fuel combustion required to run it.

Walk-in cold rooms and e-mobility can improve food security by sustainably transporting and preserving crops. Food spoilage is a major challenge worldwide: 1.3 billion tons of food spoil each year. Cold storage solutions have the potential to reduce post-harvest losses and enable better commercialisation of agricultural produce in national, regional and international markets. Fresh produce is able to be of higher quality when transported quickly, and therefore of higher value, allowing sellers to earn more money. Start-ups targeting rural agricultural productive use appliances offering e-cargo three-wheelers are helping farming communities to transport their produce faster and more easily to markets by allowing up to 400kg of cargo on the vehicle.

Finally, e-mobility can also help prevent global CO2 emissions and localised air pollution by reducing tailpipe vehicle emissions. Renewable energy sources are key in ensuring that manufacturing is low-carbon. 2- and 3-wheelers are the fastest growing transport mode in many low and middle-income countries. Analysis from UNEP found a rapid global shift to battery-electric motors could reduce CO2 emissions by 11 billion tons between now and 2050 while lowering fuel and maintenance costs by USD 350 billion.

State of Play: Nascent Markets, Uncertain Futures

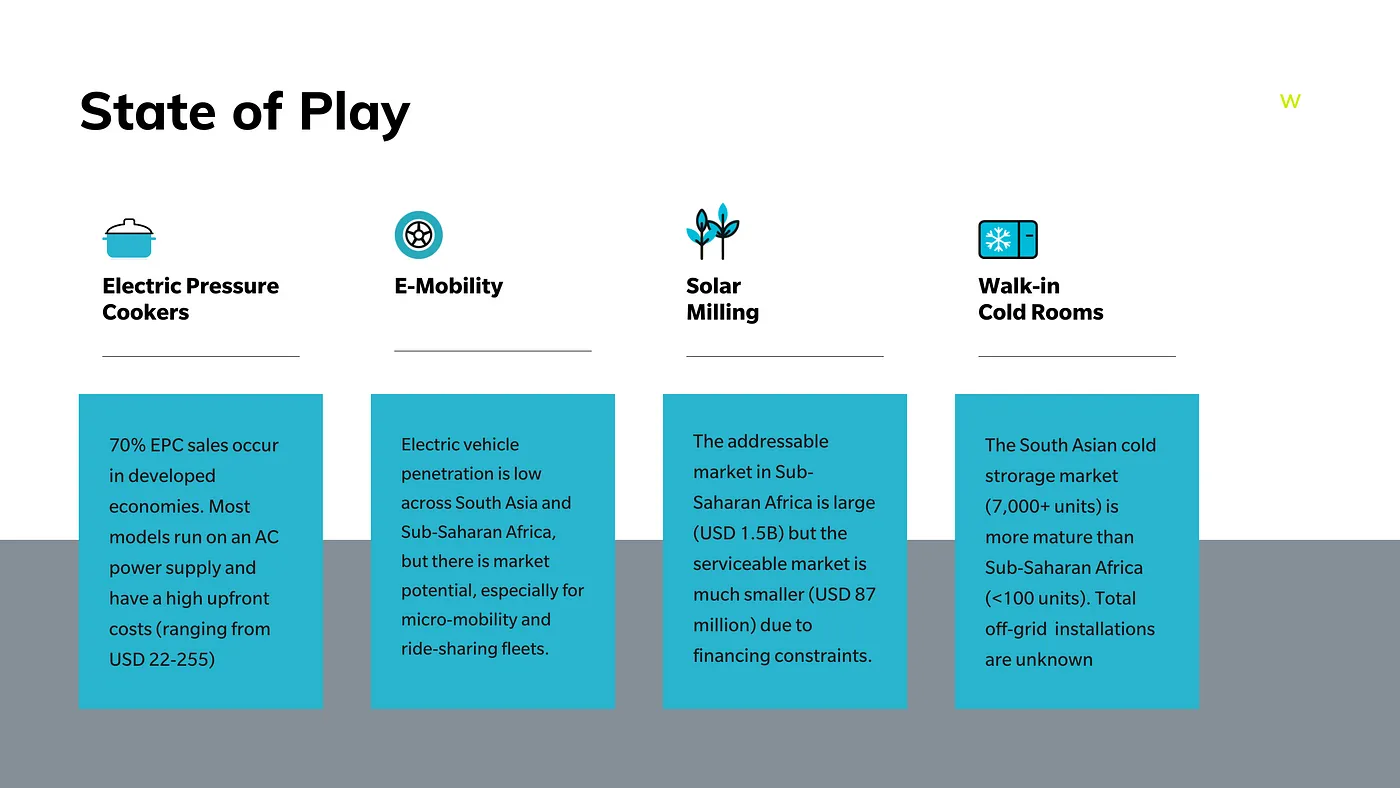

Despite their strong potential to unlock higher tiers of energy access and economic and social development, horizon technologies remain far from achieving scale in off- and weak-grid markets (Figure 2):

- Over 70% of all EPC sales take place in developed economies with reliable grid connections. Not only does the cost of the product makes it out of reach for consumers in weak and off-grid communities, but there is also an outstanding lack of commercially available, efficient and high-quality DC-powered EPCs for those served by solar home systems.

- In 2018, the Sub-Saharan Africa addressable market value for all small-scale (<1kW) agro-processing was estimated at USD 1.5 billion. The serviceable market, accounting for affordability and access to financing constraints, however, was estimated at merely USD 87 million. The serviceable market is projected to grow to USD 417 million by 2030 if product costs are reduced and the proportion of people who can afford the agro-processing units increases.

- With over 7000 walk-in cold room installations, the cold storage market for India is more advanced than that in Sub-Saharan Africa. However, the majority of these installations are on the grid and unknown how many are in off- and weak-grid settings. In distributed energy settings for the Sub-Saharan Africa market, less than 100 installations are estimated owing to among other things high CAPEX cost of these technologies.

- India’s e-mobility market is more advanced than in Sub-Saharan Africa. Electric 2- wheeler sales reached 152,000 in 2020. However, the market penetration of all e-mobility solutions in India itself is less than 1%, demonstrating the nascence of the market. Markets in Sub-Saharan Africa, while growing, are also quite young. One in four e-mobility companies active in Kenya is less than a year old.

Looking Forward: Creating Strong Commercial Markets

Ultimately, the maturity of these nascent, horizon technologies will benefit greatly from an enabling environment fostered by a diverse set of stakeholders with aligned objectives including governments, energy service providers and the private sector, actors who have traditionally not engaged frequently in the off-grid solar appliance market.

Our 2021 Solar Appliance Technology Briefs provide several pathways on how off- and weak-grid markets can jumpstart the commercial markets for these technologies. Important considerations include:

- Continued R&D will be imperative in developing and scaling the nascent markets for horizon technologies. For EPCs, cold storage units and solar milling, the limited product performance data gathered from laboratory and/or field-testing show potential for efficiency gains and design improvements to increase product viability across geographies. E-mobility technologies, however, are merely emerging in Sub-Saharan Africa and require on-the-ground piloting specific rural demographics and terrains. Extensive R&D is required to identify and meet the various mobility needs of rural communities, as well as test the foundations for the wider system operation, involving the consideration of renewable energy sources, charging infrastructure and interoperability.

- Increased financing for both consumers and suppliers. The high capital cost of the limited commercially available cold storage units (up to USD 6,000) and EPCs (up to USD 350) hinders access to low-income consumers. Suppliers, on the other hand, continue to find it difficult to access working capital and grants due to quickly evolving business models and the perception of high-risk investment by private and public investors. Emerging e-mobility business models using battery-swapping units and imported vehicles for testing have required high capital investment. The markets for these products need long-term investment and patient capital by donors and investors that will incentivise consumers to utilise the products, while also allowing suppliers to explore resource-efficient and financially sustainable business models.

- Governments, in partnership with energy service providers and donors, can grow the nascent supply and value chains by supporting policy instruments and developmental mechanisms including financing such as end-user subsidies and results-based financing tied to the SDGs. For example, this can take the form of encouraging financial institutions to provide financing packages attractive for small businesses and enterprises dedicated to walk-in cold rooms solutions, redirecting subsidies and incentives from polluting fuels (i.e., diesel and kerosene) toward solar-powered mills and EPC and implementing policies to grow local e-mobility manufacturing.

For more insights on cold storage, EPCs, e-mobility milling equipment and more off-grid appropriate appliances, please see our full collection of long-form technology briefs and snapshots. We will continue to launch these for other technologies throughout the summer. Up next in August are enabling technologies (ICT equipment, interoperability and PM motors). We will also publish a full synthesis report that summarises the state of play for the entire off-grid appliances market. Please be sure to subscribe to our newsletter to be notified of all new releases.

***

About the 2021 Solar Appliance Technology Brief Series

The 2021 Solar Appliance Technology Briefs synthesise the latest market intelligence and chart the pathway to commercialisation for 11 disruptive technologies, including refrigerators and SWPs. New collections of technology briefs will be released monthly from May 2021 through August 2021, with groupings based on our assessment of their market maturity level. Each release will include a summary blog post, highlighting key similarities and differences across the featured technologies and the interventions needed to scale. Category groupings include near-to-market appliances (TVs and fans), emerging appliances (SWPs and refrigerators), horizon appliances (electric pressure cookers, cold storage, milling equipment and e-mobility) and enabling technologies (permanent magnet motors, ICT equipment and interoperability).